Recently submitted court records in the FTX insolvency case reveal that the exchange’s new CEO, John Ray III, has been exploring a revival plan for the now-disabled trading platform and the “preliminary formation of restructuring strategies.”

FTX’s Revival Prospects Surface as New CEO Explores Reboot Plans and Bidder List

The current CEO and main restructuring officer of FTX appears to be examining the possibility of relaunching the exchange, as indicated by a court document detailing the company’s staff and compensation report for the period from April 1, 2023, to April 30, 2023. This isn’t Ray’s initial mention of such a plan, since he discussed rebooting in his first interview following FTX’s collapse in mid-January 2023.

In April, FTX’s present operators uncovered $7.3 billion in liquid assets, and legal professionals debated resuming the exchange later as a potential means to restructure its debt. It seems that Ray has been engaging with certain organizations to assess relaunch possibilities. For example, on April 4, Ray deliberated an “exchange fortification” proposal with cybersecurity firm Sygnia.

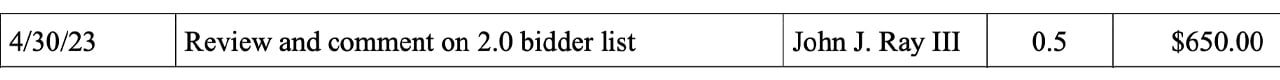

Ray examined a “2.0 next steps” summary and a “2.0 reboot of exchange material” on April 14 and April 19. The court record also references a “2.0 bidder list,” implying that the restart endeavor could be sold to another cryptocurrency market player. With a billing rate of $1,300 per hour, Ray accrued $290,160 for his recorded 223.2 hours of work within the compensation report.

Report reviews can cost between $390 and $5,850, while the fee to “review and comment on 2.0 bidder list” was $650 according to the document. As this news spread throughout the crypto community, FTX’s native token FTT saw an increase of over 14% in value within the past day. On Tuesday, May 23, FTT traded at prices ranging from $0.992 to $1.16 per unit, amassing approximately $26 million in global trade volume.

What are your thoughts on FTX’s potential revival and the involvement of its new CEO in exploring restructuring strategies? Share your opinions and insights in the comments section below.

from GJ https://ift.tt/ZpoTY6w

via nmkadda

No comments:

Post a Comment